- Undergraduate

- Continuing Students

- Graduating Students

- Cost of Attendance

- Incoming Students

- Parents and Families

- Net Price Calculator

- Loans

- Scholarships and Grants

- Federal Work-Study

- Frequently Asked Questions

- Forms

- Contact Us

- Make an Appointment

- Satisfactory Academic Progress

- Summer Aid

- Information Guide

- Financial Wellness Peer Coaching Program

- Follow

»Federal Loan Counseling and Master Promissory Note

Federal Loan Entrance Counseling

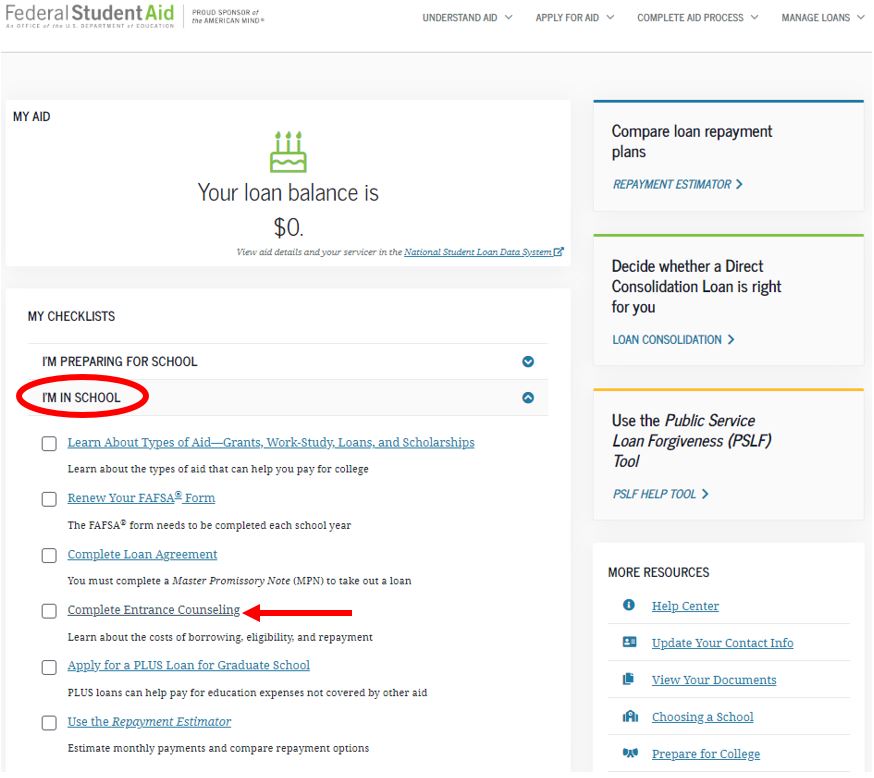

Federal Loan Entrance Counseling is a process set up by the Federal government to educate new students about loans and the Federal Direct Loans program. It consists of a short mandatory information session that will help you learn about your rights and responsibilities as a borrower. The process takes about 15 to 20 minutes to complete.Federal Loan Entrance Counseling can be completed online atStudentAid.govby signing in with your (the student's) FSA ID Username and password. After logging in, expand the "I'm In School" drop-down menu and select “Complete Entrance Counseling”to begin your Loan Entrance Counseling.

Upon successfully completing Federal Loan Entrance Counseling, an electronic statement of completion is generated within the Federal Direct Loans system.Processing for this statement can take up to two business days from the point it reaches Chapman University’s system. Please be aware that this only applies to the Federal Direct Loans. Other loans, such as the Chapman Interest-Free Loan and private loans have their own requirements that must be completed.

Master Promissory Note

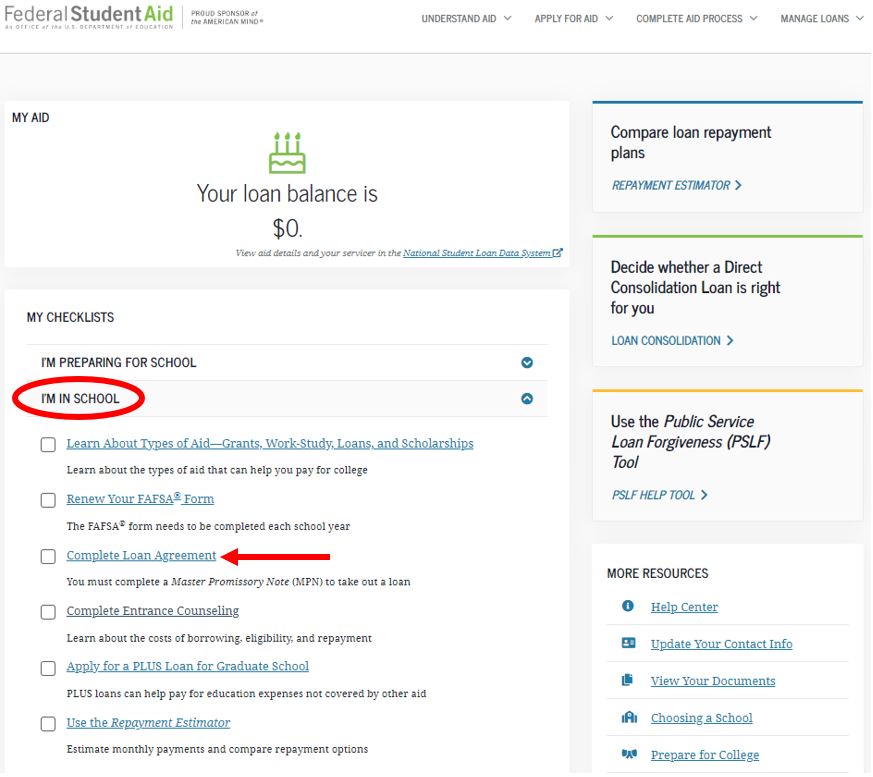

It may be requested that you complete a MPN if one has not already been completed.A MPN can be completed by logging intoStudentAid.govand selecting"Complete Loan Agreement" from the "I'm In School" drop-down menu.

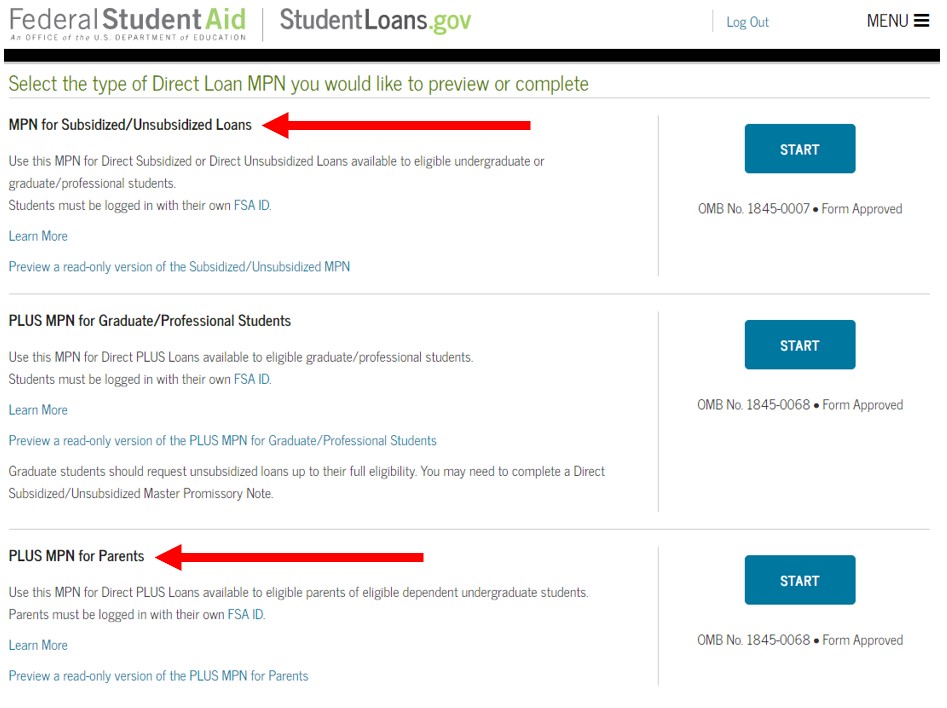

Make sure to select the correct MPN type if you are a student borrower or parent borrower and follow the steps accordingly. Once completed, an electronic MPN will be generated. You may wish to print a copy for your personal records. These electronic MPNs are sent to Chapman University’s system twice a week and may take up to two additional business days for processing.

Note that a MPN must be completed by each borrower. Federal Direct PLUS loans require a separate MPN. For Parent PLUS borrowers, the PLUS Loan MPN must be completed by the borrowing parent.