- Follow

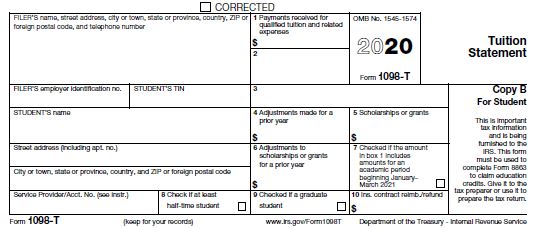

»1098-T: Tax Statement

Effective in calendar (tax) year 2018, the IRS (Internal Revenue Service) has changed the reporting requirements for form 1098-T. In previous years, your 1098-T may have included a figure in Box 2 that represented the qualified tuition and related expenses Chapman University billed to your student account for the calendar (tax) year.

Per the new IRS regulations, colleges and universities will no longer use Box 2. All “amounts paid” will be in Box 1 for qualified tuition and expenses. For more information, please visit the IRS website to learn more about this.

The Tax Year begins on January 1 and ends December 31..

Chapman University works with ECSI to provide Chapman University students their 1098-T statements. 1098-T statements will be available electronically or mailed by January 31 to the current address on record at the time of processing.

There are two established education tax credits both by the Taxpayer Relief Act of 1997 (TRA-97): American Opportunity Credit and the Lifetime Learning Credit.

Neither your school, nor its Tax Credit Reporting Service (ECSI), can provide individual income tax advice. After reviewing this information, if you have any 1098-T tax related questions regarding your tax credit, your eligibility, reporting your tax credit on your tax return, or any other 1098-T specific concerns, please consult your tax professional or the IRS at 1-800-829-1040 or www.irs.gov.

The deadline to submit the W-9S eForm is December 17, 2025.

Additional Resources:

1098-T Tuition Statement: Frequently Ask Questions

- All payments received within the calendar year, that applied to qualified educational expenses, are reported in box 1 on the 1098-T.

- Yes, if there are qualified educational expenses that are paid within the calendar year.

- Certain financial aid will apply to tuition and fees, before student payments. The change will be reported in box 6 as "adjustments to scholarships and grants in the prior year".

- Please visit the IRS website or view this qualified educational expenses PDF.

- All students that had qualified activity in the calendar year will be able to view their 1098-T online via the ePay site.

- Yes, the student can provide access from their student center and designate a Panther Partner Authorized User. Once a Panther Partner Authorized User is set up, the student can provide consent to the designated Panther Partner Authorized User to receive the 1098-T electronically.

- Yes, if the student provided consent, both student and Panther Partner Authorized User will receive an email.

- The student will need to log-in to their student center via my.chapman.edu and click on "Access ePay". From the ePay site, the student would select "View 1098-T Statement".

- Panther Partners Authorized Users, who have been given consent, may log-in to their Access ePay portal using their credentials.

- The 1098-T will be mailed by January 31 to the permanent address on file at the time of processing. It will also be available to the student electronically via the ePay site.

- If student has payments for qualified educational expenses in the calendar year and did not provide ITIN or SSN, Chapman has partnered with ECSI who will generate the Tuition Statement, but the Student Tax Payer Identification filed on the 1098-T will be blank.

- The student will need to submit a new W-9S form on their Student Center.

- No, you must contact your tax professional or the IRS at 1-800-829-1040 or www.irs.gov.

1098-T Tuition Statement: Brief Box Description

Box 1 - All payments made towards qualified educational expenses received in the calendar year.

Box 4 - Shows any adjustment made by an eligible educational institution for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax liability for the year of the refund). See "recapture" in the index to Pub. 970 to report a reduction in your education credit or tuition and fees deduction.

Box 5 - Only scholarships, grants, and third party activity in the calendar year.

Please note: Amounts you received from the CARES ACT student refund for unexpected expenses, unmet financial aid need, or expenses related to the disruption of campus operations are NOT reported in Box 5 per IRS guidelines. IRS FAQ’S

Box 6 – Adjustments to scholarships, grants, and third party for a prior year. 2019 will be the first year you may see amounts reported in box 6.

Box 7 - Qualified payments received for future term January-March.

Box 8 – At least half-time student.

Box 9 – Graduate student.